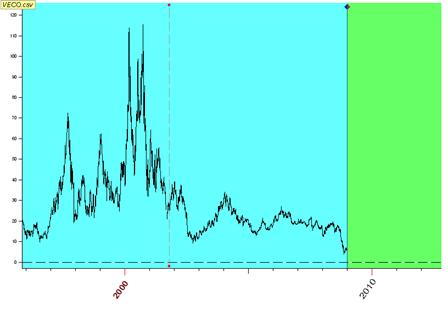

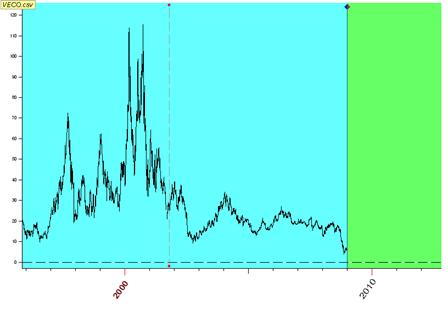

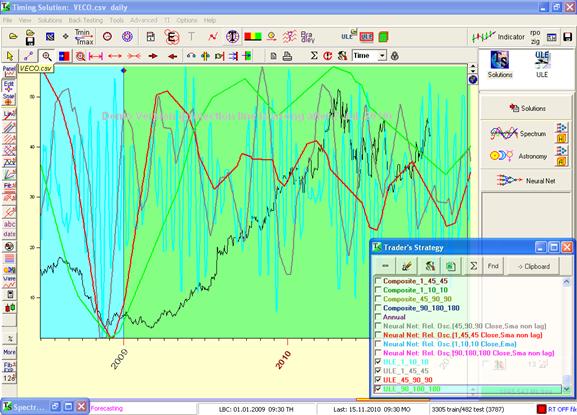

VECO

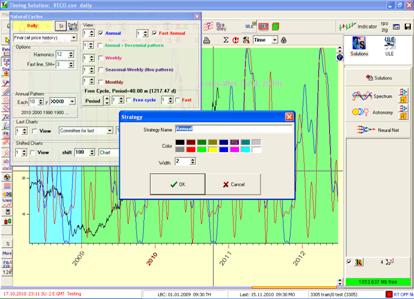

research � Strategies

1.

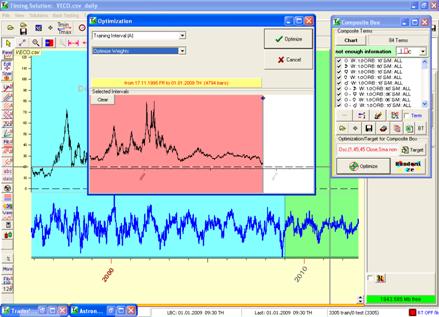

Load price data

Load VECO daily from 1995 to end of 2008 (2009, 2010 not included). Set

LBC to end � all price bars.

2.

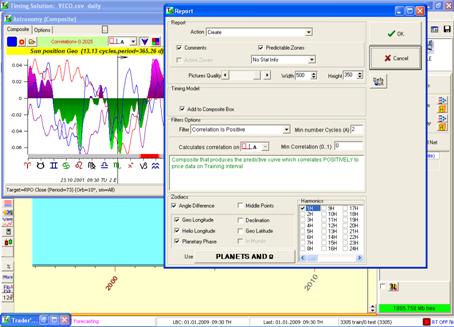

Composite:

Make composite using report with the following parameters:

The first composite line includes all the events that have positive

correlation on segment A (total 84).

Optimize composite to (1,45,45, sym1,close) on interval A, all bars:

The result:

Send to strategy.

Make optimizations also for the following and send to strategies.

�

(1,10,10, exp,

close)

�

(45,90,90,

sym1,close)

�

(90,180,180,sym1,close)

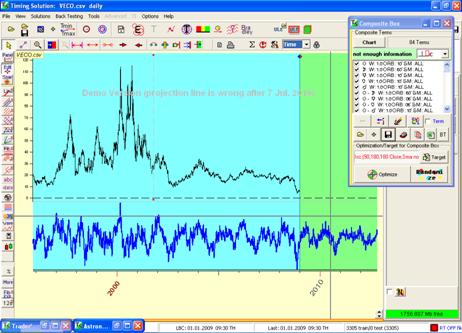

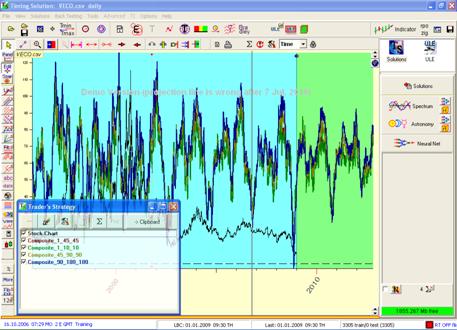

All strategies for Composite:

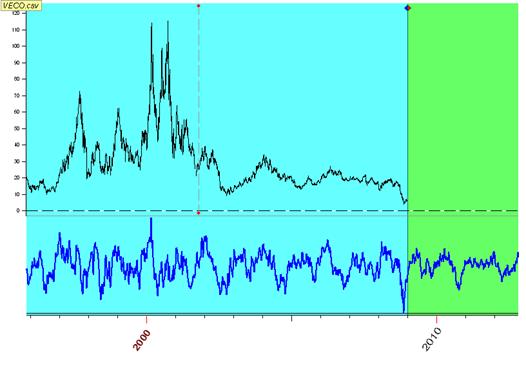

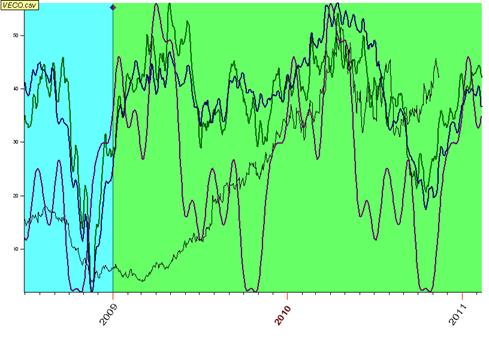

Update the price data for VECO for 2009+2010 using �data feeding� from

file, without changing the LBC so see if those strategies are good 2 year ahead.

Conclusions:

all composite projection lines are very similar.

3.

Annual Cycles:

Enable annual cycles, send to strategies.

Compare

annual strategy to Composite strategies.

4.

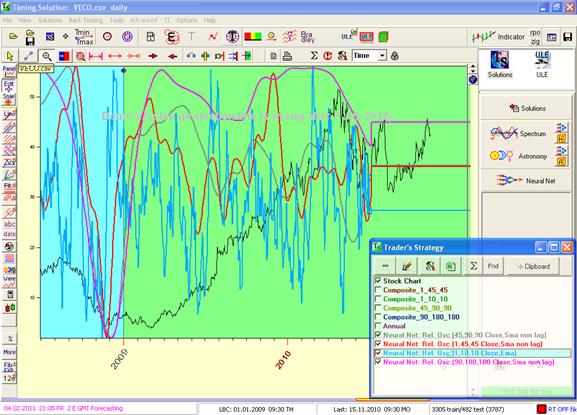

NN Spectrum model:

Use TS4.ts solution for spectrum,

Use the following targets and send to strategies:

�

(1,10,10, exp,

close)

�

(1,45,45,sym1,close)

�

(45,90,90,

sym1,close)

�

(90,180,180,sym1,close)

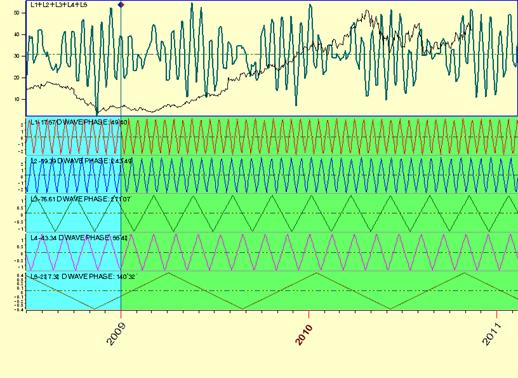

5.

Selected Spectrum

cycles to ULE models:

Select the

cycles (1 overtone, triangle) and drag to screen with Stock market =7. Send

to strategies.

Use the following targets in Spectrum, use ULE and send to strategies:

�

(1,10,10, exp,

close)

�

(1,45,45,sym1,close)

�

(45,90,90,

sym1,close)

�

(90,180,180,sym1,close)

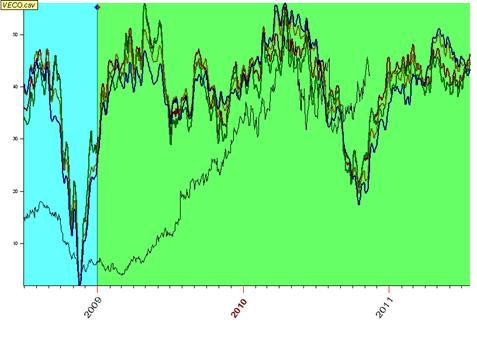

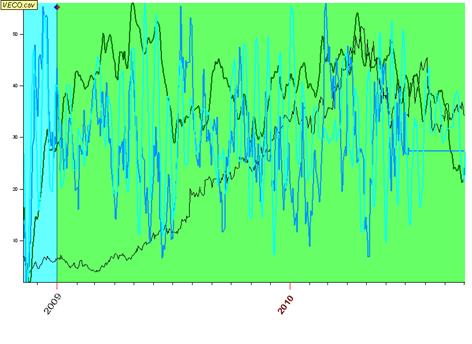

All Selected-Spectrum-cycles-to-ULE strategies:

Comparing

strategies

Comparing

strategies (1,10,10,exp,close)

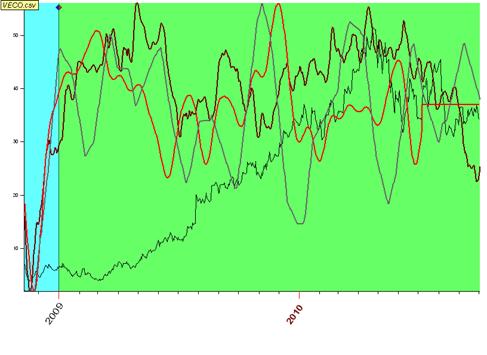

Comparing

(1,45,45,sym1,close)

Comparing

(45,90,90,sym1,close)

Comparing

strategies (90,180,180,sym1,close)

Best

Fit Strategy

SUM of

Compsite_90_180_180 and ULE_90_180_180